South Asia agents bullish on the recovery of international student flows

Expectations for outbound flows improve over time – while a full recovery in outbound flows can be ruled out for 2021 for China and South East Asia, agents in South Asia have a bullish outlook.

The recovery in global student mobility will be first and foremost a function of outbound student flows from the various sending countries. Many of these countries have had significant success in managing the pandemic (including China, Vietnam, Thailand, South Korea) while others continue to struggle to get the virus under control (including India, Indonesia, parts of Latin America).

Multiple factors will impact on new commencements in the second half of 2020

The Navitas agent survey conducted in September 2020 asked almost 300 agents to provide their views on the following question: “What do you anticipate will happen to the number of new students you help to study abroad between July and December 2020, compared to the same period in 2019?”

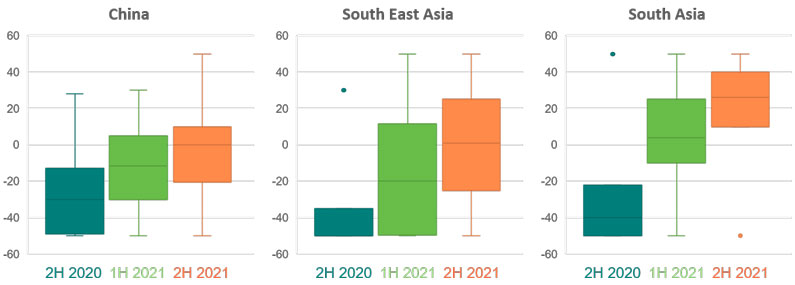

As is to be expected, agents are anticipating negative flows in the second half of 2020 with a large proportion anticipating a fall in new commencing students compared to the same time last year. As the following figure shows, expectations vary by region, but all regions anticipate that the second half of 2020 will be 30 to 40% lower than 2019 levels. This is of course a function of the ongoing impact of the pandemic, border closures, lockdowns, and a disrupted aviation industry. Falls in new commencements in the range of 20 to 30% for Australia and 30% for Canada certainly appear plausible, if not likely, based on Navitas’ analysis of the latest available official statistics.

A moderation of the impacts of the pandemic is anticipated for the first half of 2021, especially for South Asia

Looking further ahead to the first half of 2021, agents in China expect new student volumes to be down 10% on 2019 levels. Agents in South Asia are optimistic with many expecting a strong rebound to reflect growth of around 4% on the corresponding pre-COVID period. Agents in South East Asia on the other hand remain pessimistic, with growth expected to remain 20% down on pre-pandemic levels.

Many agents expect that students will be able to travel in 2021, so both optimism and pessimism are likely to be reflective of student and parent intentions rather than government policy constraints. These intentions may be curtailed by the financial impacts of the pandemic, or ongoing concerns around safety. This positive perception is largely driven by the fact that relative to the situation in India and other parts of South Asia, the UK may be seen to be managing the pandemic effectively, underpinned by a strong (albeit currently stretched) public health system.

By the second half of 2021 new student volumes from South Asia could pull away from other source regions

The difference between the bullish outlook in South Asia and the bearish expectations for China and South East Asia are most pronounced in agents’ forecast for the second half of 2021. At this point in time, the expectation is that many countries will be on the journey back towards pre-COVID normal conditions. The median view of agents in China and South East Asia is that this will accompany a return to 2019 levels. In contrast, agents in South Asia are anticipating growth of around 25% compared to the corresponding period pre-COVID.

Across the three time periods, agent predictions span a wide range. As a general rule, agents in South Asia tend to reflect the greatest level of consistency and agreement, while agents in South East Asia show a wider diversity of views on what is likely to eventuate, particularly in 2021. Agents in China are mostly in agreement but there tends to be more outliers, both positive and negative represented in the spread of views.

Figure 1: What do you anticipate will happen to the number of new students you help to study abroad between July and December 2020/January and June 2021/July and December 2021, compared to the same period in 2019?

There are several possible explanations for greater optimism for growth in 2021 amongst agents in South Asia. First, many students from South Asia are seeking opportunities to concurrently work and study, and as such online and transnational options do not provide a desirable substitute for an in-person experience. Second, it could be that students from South Asia are less ‘sticky’ and more footloose; it is therefore a question of ‘where’ prospective students will travel to in 2021, and not a question of ‘if’. Third, India’s outlook in terms of managing COVID-19 remains of great concern, and studying overseas may be seen as an important avenue to secure both health security and economic prosperity in 2021.

You may also be interested in further insights on market share.