Distinct student priorities and preferences set the Greater China region apart

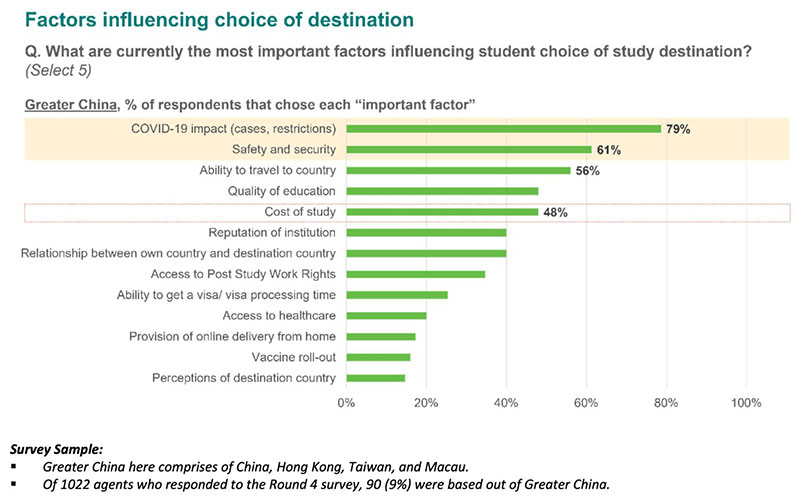

COVID-19 is still top-of-mind in Greater China and cost of study is significantly less important than other regions

In our latest round of agent perception research, almost 80% of agents from the Greater China* region report that COVID-19 impact remains an important factor influencing choice of study destination. This is in stark contrast with almost all other regions, where COVID-19 has become a negligible concern and more traditional factors of affordability, quality and post-study work rights have returned to the fore.

The Chinese Government’s continued pursuit of zero-COVID is likely the key explanation for this distinction. China has seen fewer than 100 cases per day across the country since mid-2020, and students and their parents will be aware of the markedly heightened risk they face from a COVID perspective if they choose to study abroad.

Compared to other regions, cost of study is less of a priority for students in the Greater China region. Cost of study was only the fifth most cited factor and over 50% of agents from Greater China did not select “Cost of study” as an important factor at all.

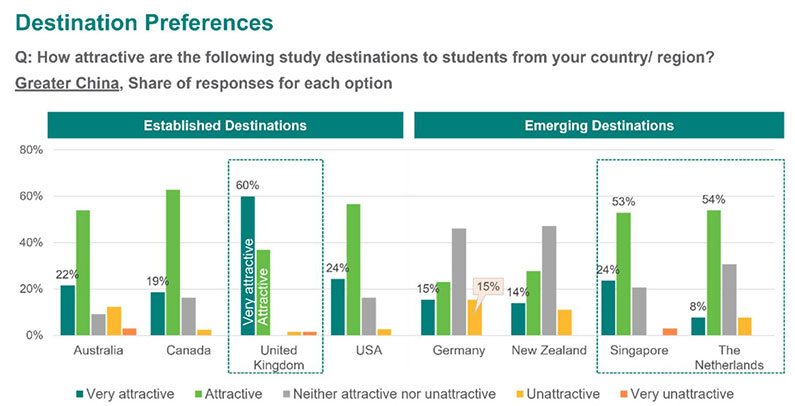

There is a pronounced excitement about the UK as a destination

In the latest round of research, 60% of agents from Greater China said the UK is a “Very attractive” education destination, while for the remaining established destinations, the responses were tepid –only 20-25% of agents deemed them such.

In particular, Australia’s reputation amongst agents from this region is at a low point, with more agents describing it as ‘unattractive’ or ‘very unattractive’ than any other established destination. Kim Eklund, Regional Sales Director for the Greater China region suggests there are many reasons for this sentiment. “Announcements regarding border openings have come too late to have any material impact on the first semester for 2022 and, in addition, we are seeing concerns about COVID-19 increase further since this survey was conducted, especially with the new variant. There are also lingering concerns that students may not be able to leave Australia or have family come and visit. It’s going to take time for student numbers to Australia to recover from this region,” he said.

Among the emerging destinations, Singapore and The Netherlands stand out – 77% of agents believe Singapore is attractive and 62% believe the same for The Netherlands. On Germany, only 38% of agents responded positively (vs. 73% for other regions) and 15% consider it to be unattractive as an education destination.

While covid safety remains a key priority, agents perceive that less than half of their student families have been financially impacted by the pandemic.

Agents from Greater China estimate ~40% of their students have been financially impacted by COVID-19 (vs. 54% across other regions). Of these students, agents estimate ~60% are to some extent less committed to studying overseas. As suggested by Kim Eklund above, there are a range of reasons why students from this region are more reluctant to commit to overseas study, including concerns about Covid-19 and the ability to be able to see friends and family.

*For the purposes of this report, Greater China includes China, Hong Kong, Macau and Taiwan.