Interest in Australia and Canada cools as governments introduce tougher policy and regulatory measures

Australia has dropped and Canada has plunged in terms of preferred study destinations for international students

Round 8 of the Navitas Agent Perception Survey, conducted between 25 April – 3 June 2024, comes amid a difficult backdrop for the international education sector. In many countries, the post-COVID enrolment rebound has come to an abrupt halt as governments around the world look to tighten policy settings to reduce the flow of international students.

Reasons cited include the need to reduce pressure on housing supply and affordability, and the need to improve provider and broader migration system integrity. The cause and effect of such policy measures though remain hotly contested across the sector.

In 2024, Canada and Australia are the most prominent countries to have introduced more restrictive policy measures. In December 2023, Canada announced an increase in the financial requirement for international students applying for a study permit, with students needing to prove they have CAN$20,635 in available funds, more than double the previous amount. At the start of 2024, Canada announced a two-year cap on new international student permits, the first country to ever implement such a policy. The cap will impose a significant constraint on college and undergraduate enrolments, with an intended 28% reduction in the number of approved study permits compared to last year.

Following the introduction of a raft of new measures for several months prior, the Australian government subsequently announced in May 2024 the intention to also cap the number of international students in Australia. The proposed legislation provides the Minister for Education unprecedented powers to set caps on the number of international enrolments for providers, regions, and courses.

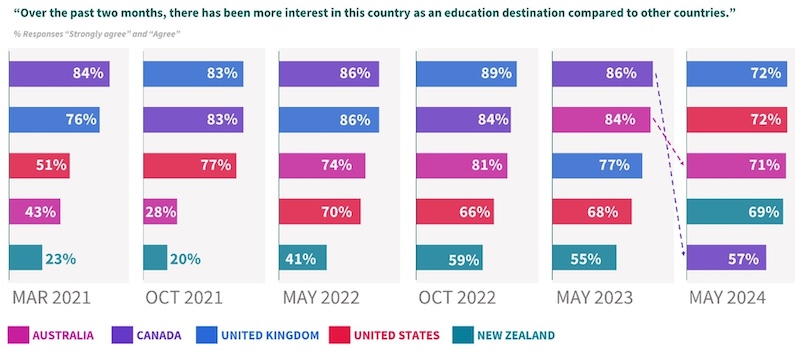

Since the inception of the Navitas Agent Perception Survey, agents have been asked to consider whether student interest in studying in various study destinations had increased in recent months. The most recent results for both Canada and Australia paint a sobering picture.

Canada has traditionally performed extremely strongly in this question, reflecting its perennial status as a highly sought after study destination. As Figure 1 shows, between March 2021 (Round 3 of the survey) and May 2023 (Round 7 of the survey), Canada ranked either first or second. Australia, during the peak of the COVID years, ranked lower down due to its closed border policy, but in recent years had been recovering, reaching second place in last year’s survey.

Both countries have seen a decline in the most recent survey, Canada most significantly. Canada tumbled from first to fifth place, with a decline of 29 percentage points in the proportion of participants that agreed or strongly agreed, while Australia fell a spot to third, decreasing by 13 percentage points. Australia’s drop has not yet put it out of contention as agents, and by extension students and parents, await the implementation detail.

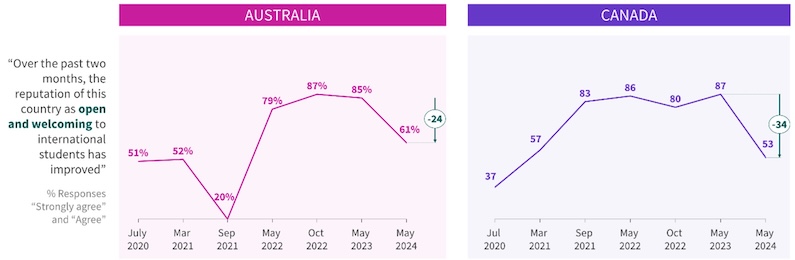

Given the direction of policy changes, it is unsurprising that Australia and Canada’s reputations for being open and welcoming have suffered. As the figure below illustrates, both countries have seen a significant drop off in terms of the percentage of agents that ‘agree’ or ‘strongly’ agree’ that in recent months the reputation of these respective countries as being open and welcoming have improved.

“Canada’s new study permit caps and other policy changes have left many prospective international students confused and concerned. We have seen a profound decline in interest from prospective students applying to Canadian institutions this fall. This, combined with further delays in study permit processing, will further damage Canada’s reputation as a study destination. It may take several years to recover.”

Livia Castellanos, VP Marketing and Recruitment, University Partnerships North America

“Prospective international students are watching closely how Australia’s proposed managed system will play out. It remains to be seen whether Australia’s attractiveness will be permanently affected or whether it will bounce back once the policy detail has been revealed. The way the government communicates with the market will be critical in restoring confidence.”

Michelle Von Karlowitz, GM Sales and Marketing, University Partnerships Australasia

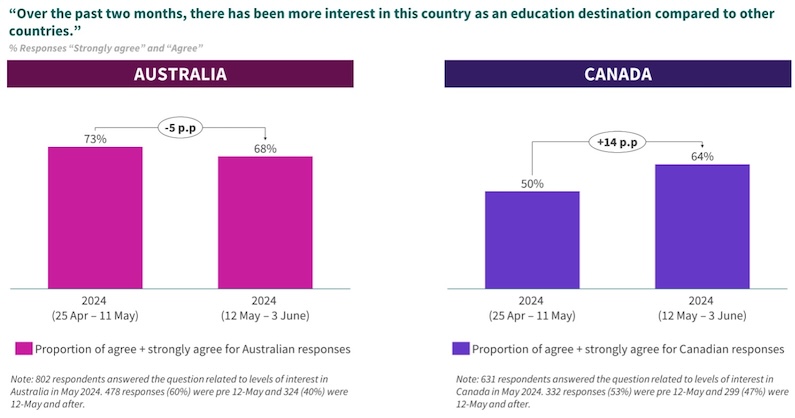

Australia’s “soft cap” policy announcement during the survey period provides insight into how quickly policy signals are processed, and how agile the market has become

Australia’s policy announcement on the introduction of caps occurred on May 11, midway through the data collection period for this round of the Navitas Agent Perception Survey. As the graph below shows, the proportion of agents that “agreed” or “strongly agreed” with the proposition that interest in Australia had grown over the past two months fell by 5 percentage points before and after the policy announcement. This small but noticeable drop illustrates how closely news is tracked in destination countries (political, economic, or otherwise) and how quickly new information is absorbed into decision-making.

The news in Australia correlated with a sharp uptick in interest in Canada. Levels of interest in Canada grew by 14 percentage points pre and post Australia’s policy announcement, from 50% of agents indicating they “agree” or “strongly agree” to 64%.

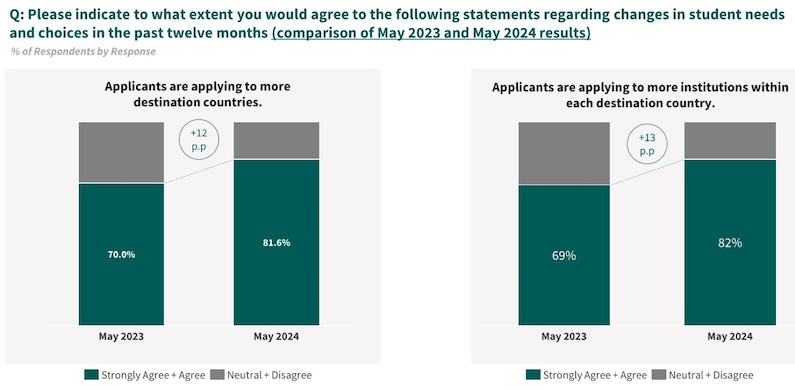

The correlation between Australia’s policy announcement and increased interest in Canada may be initially surprising but is reflective of a growing trend towards student’s casting the net wider when making study choices. The Navitas Agent Perception Survey has shown that students are more likely to hedge their bets by applying to (a) more institutions as well as (b) more destination countries since the COVID-19 pandemic. As the graph below shows, there has been a continued increase in the proportion of agents that agree with both propositions.

“We have seen a more than usual increase in students applying to more institutions across our network. While, in itself, the norm for a pathway provider, the emerging trend is for students/agents to apply to more than one destination country and in many cases one or more of these are NESD [non-English speaking destination] countries. Students have lost confidence in both Australia and Canada and are looking to some of the newer European and Asian destinations, especially where visa processing is perceived to be more transparent and more welcoming to international students.”

Tony Cullen, Executive General Manager of Global Engagement

Waning interest in the short term is not reflective of Australia and Canada’s overall attractiveness as a destination – at least, not yet.

While Australia and Canada’s policy announcements signalling a less welcoming stance to international students has impacted interest in these countries in the short term, both destinations retain a strong base of good will amongst the market. This is borne out in agents’ responses to the question about the attractiveness of each study destination to students in their country. Australia’s attractiveness as a study destination remained unchanged with 89% indicating it was “attractive” or “very attractive” and Canada’s level of attractiveness fell only five points from 90% to 85%, despite the significant decline in interest.

The fact that the long-term appeal of each country remains strong, is positive news for institutions and governments in Australia and Canada, but it does remain to be seen whether short-term impacts will ultimately undermine long-term appeal. As the market for international students becomes ever more competitive, the major English-speaking destination countries will have to be increasingly mindful of balancing short-term priorities with long-term protection of its international education reputation.

A summary report of this survey’s findings is available to download here.