South Asia and Greater China: What matters to students & which destinations are winning?

As part of the Navitas Agent Perception Survey, we have been tracking agent perceptions on the factors that most influence a student’s choice of destination since 2020. In this latest round (October 2022) we have gone a step further; for the first time, we have also asked agents which destinations they believe are “winning” on each of the factors. In this article we discuss results on these two questions for the two largest source regions for international education: Greater China and South Asia.

What matters to students?

To begin with, we review the choice factors that have come up top in the most recent round of the survey and examine the changes we’ve seen over time around what matters to students.

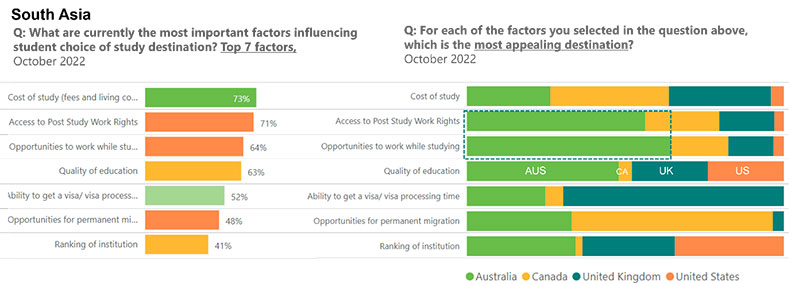

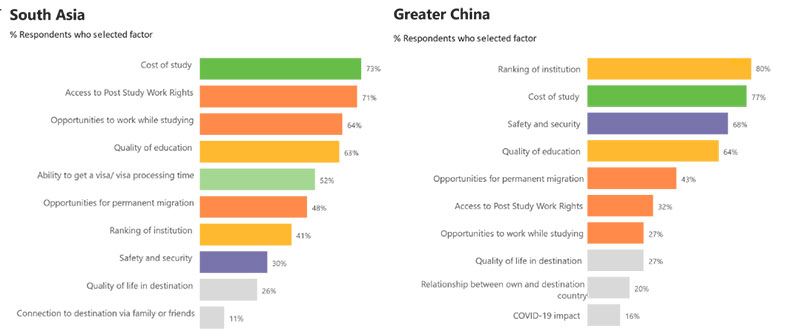

It is immediately apparent that there is a significant difference between students from Greater China and South Asia in terms of factors that influence their choice of destination (Figure 1). Looking at the “Top 5” most cited factors, only two out of five factors overlap between the two regions: Cost of Study and Quality of Education.

Greater China’s top ranked factor in this round was “Ranking of Institution”. The consensus on this was strong; 80% of agents from the region selected it as a top 5 factor. By contrast, institute ranking was ranked 7th in terms of importance by agents in South Asia. The third most cited factor by agents from Greater China was “Safety and security”, ranked 8th for South Asia. Likewise, two of the “Top 3” choice factors for South Asia – both related to employment in the destination – were ranked 6th and 7th for Greater China. “Cost of study” featured within the top 3 factors for both regions.

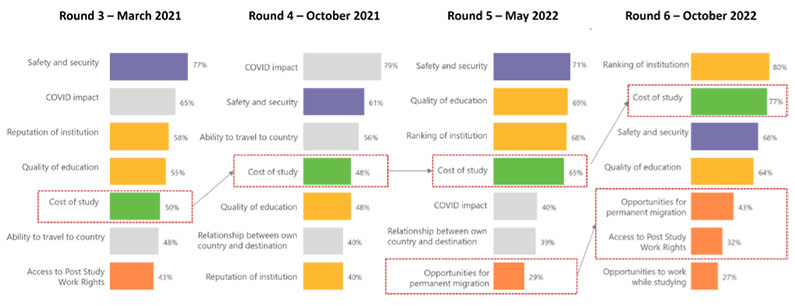

Over the past two years, across four rounds of the survey, we have seen notable shifts in the top factors cited by agents from Greater China. Cost of study has climbed up the list, from 5th place in March 2021 (Round 3) to 4thplace in October 2021 (Round 4), and ultimately up to second place in this round. Over 77% of agents from Greater China cited cost of study as an important factor, the highest we have seen since the start of the survey.

Another notable movement we’ve seen is the rise of institute ranking as a factor between the last two rounds. In May 2022 (Round 5), “Ranking of institution” came third amongst the factors for Greater China, with 68% of agents citing it as a top factor. Six months later, in this round, “ranking of institution” climbed up to be the most cited factor of all the options.

Finally, it may be worth noting the rise of “Opportunities for permanent migration” as a factor for Greater China between Round 5 and 6. A related factor, “Access to Post-study Work Opportunities”, has also increased in importance in this short period. The rise of these two factors could partially be explained by the fall in the importance of “COVID-19 impact” (in the top 5 in all earlier rounds) as destinations have now returned to normalcy. However, it may also reflect the beginnings of changing sentiment and priorities. The factors climbing in relative importance have displaced “COVID impact” as a top factor of influence; COVID impact dropped from 1st to 10th rank between October 2021 (Round 4) and the current round. That said, “Safety and security” continues to be a top 3 factor for the region.

“There is a genuine increase in interest in the opportunity to obtain destination PR/citizenship that is linked in part to COVID’s impact on the economy and job prospects. Agents have seen a significant uptick in K12 business for Australia and Canada, which is often tied to longer term or permanent plans. Other factors that will increase in importance are post-study work opportunities and the cost of study, which also haven’t been such a high priority in many years from China.” — Kim Eklund, Regional Sales Director, Greater China

Who is winning?

In this round, we introduced a new follow-up question after the question on “factors of influence” that asks agent to select the one destination that they perceive is the “most appealing” in terms of each of the factors they selected as important.

In this section, we look at who is winning across the top factors for Greater China and for South Asia, and note with interest the differences in perceptions from the two regions.

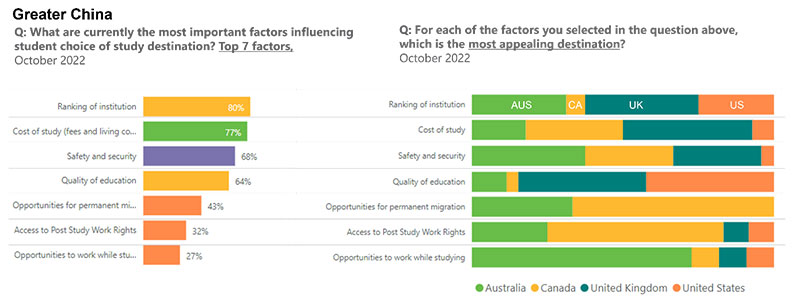

Let’s start with Greater China (Figure 3). On the top 3 factors (Ranking of institution, Cost of study and Safety and security) the major destinations are notably balanced; no clear winner emerges between the UK, Australia, and Canada, with an even share of agents choosing each as the winning destination.

Beyond the top 3 factors, there seems to be stronger consensus. Aligned to our broader understanding of the market, the UK and US come out stronger than Canada and Australia on quality of education, and Canada and Australia dominate on opportunities for migration. This suggests that Greater China might continue to bifurcate as a market – students who care most about ranking will go to the UK or US, while students who are less focused on prestige and/or are price sensitive may select Canada or Australia.

Coming back to South Asia (Figure 4), we see a clearer picture of who is winning, with Australia dominating three out of the top 5 factors for South Asia. On cost of study – the most cited factor – the vote is balanced across Australia, Canada and UK with Canada having a slight edge. On the next two most cited factors (access to PSWR and opportunities to work while studying), Australia has a clear dominance with over 55-60% of respondents selecting it as the most appealing destination for these factors. While the UK does feature in every factor, the destination stands out as a clear winner only on visa processing, while Canada comes up top on permanent migration.

These results suggest we are going to see a continued surge in demand for Australia from South Asia in the coming months.