UK and Canada compete for top spot in the pandemic recovery race

The UK and Canada have been in a fierce competitive battle to lead in the post-pandemic recovery

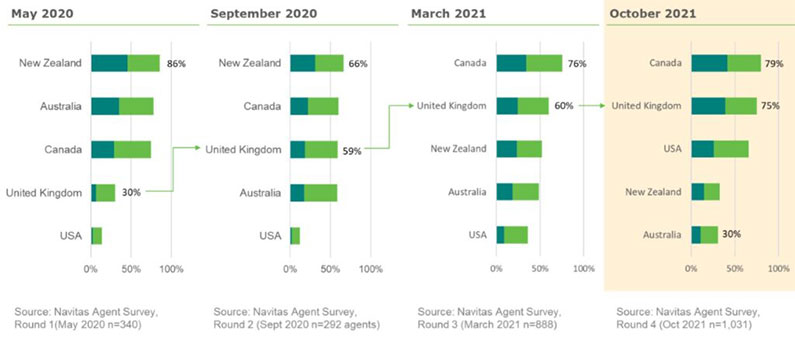

Canada started off the pandemic riding high, with almost three-quarters of agents agreeing/strongly agreeing that the government’s handling of the pandemic had made it a more attractive study destination back in May 2020. At that time, the United Kingdom was in the throes of the pandemic crisis and trailed far behind, but has since steadily closed the gap.

Figure 1: Over the past two months, the way this country’s government has handled coronavirus has made it a more attractive study destination.

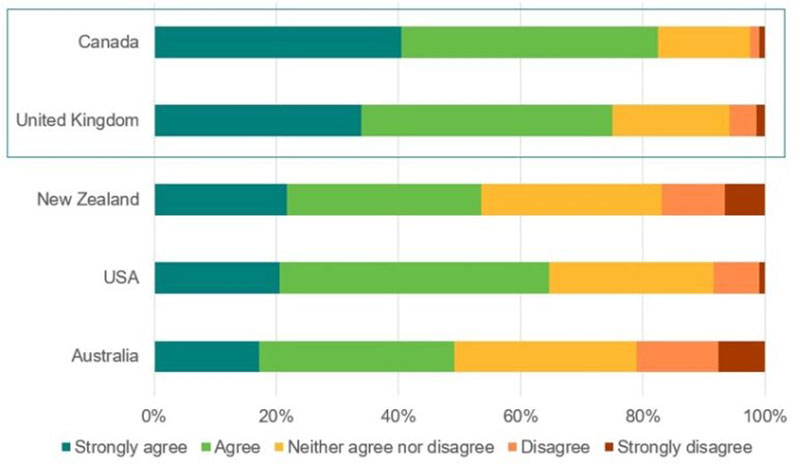

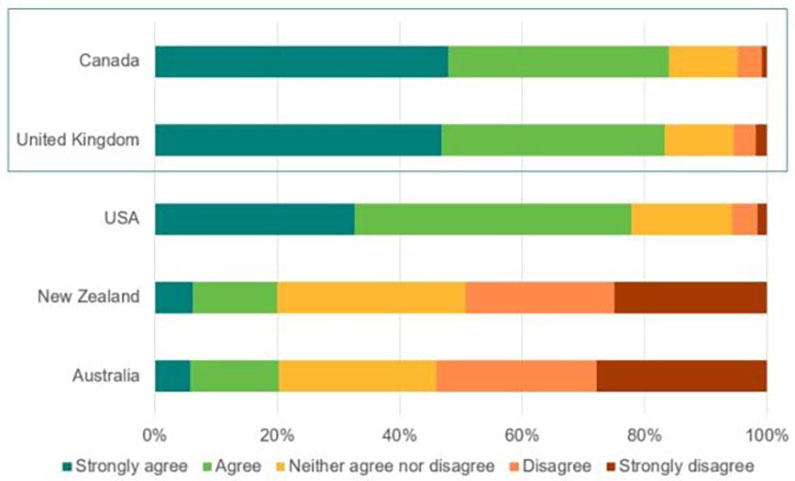

On the twin measures of ‘safe and stable’ and ‘open and welcoming’, Canada and the UK are also well matched. Canada and the UK lead on the measure of safe and stable with 82% and 75% agree/strongly agree respectively. Canada and the UK also lead on the measure of ‘open and welcoming’, with an identical score of 83% agree/strongly agree.

Figure 2: Over the past two months, the reputation of this country as safe and stable for international students has improved.

Figure 3: Over the past two months, the reputation of this country as open and welcoming for international students has improved.

Given the timing of the latest wave of the Agent Perception Survey, which was out in the field in late September-early October, these strong and timely results would suggest that Canadian and British institutions would have done well in terms of international student recruitment at the start of 2021-22 academic year. Navitas analysis of visa data from Immigration, Refugees and Citizenship Canada (IRCC) and the UK Home Office provide clear evidence that both countries have recovered to — and to some extent exceeded — pre-pandemic levels of student arrivals.

While the UK and Canada are in tight competition, they are not necessarily competing for the same students

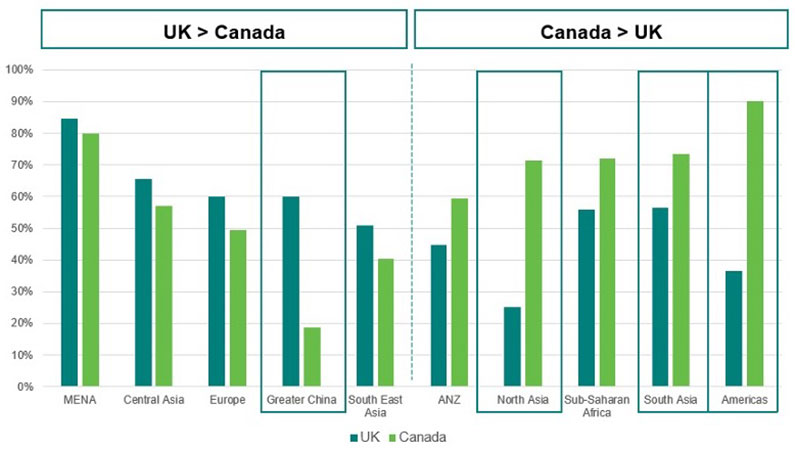

At face value, Canada and the UK look somewhat equally positioned on the world stage. In fact, there are meaningful differences that become apparent when we look at their key international student source countries.

With over 1,000 responses from 77 countries, the large respondent base of the Navitas Agent Perception survey allows deeper interrogation of these results at a regional level.

On the question of “How attractive are the following study destination to students from your country/region?”, Figure 4 shows the share of agents who selected “Very attractive” for the UK and Canada across different regions.

Out of 10 source regions depicted, five countries lean more towards the UK and the other five lean more towards Canada. While these differences are not always significant, four regions stand out.

- The Greater China region appears to demonstrate an overwhelming preference for the United Kingdom over Canada. This is a significant challenge for Canada given the sheer size of the Chinese market.

- North Asia (comprising Japan and South Korea) and the Americas (Brazil, Columbia, Mexico, and others) seem to have a much stronger preference for Canada over the UK, likely due to geographical proximity.

- As a large source market, it is interesting to note that agents from South Asia perceive that Canada is more attractive than the UK. This could be due to the clear pathway to permanent residency that Canada has offered international students for the past several years. The UK, meanwhile, has only more recently liberalised post-study work rights.

Figure 4: How attractive are the following study destinations to students from your country/region? (Share of respondents who chose “Very Attractive” for the UK and Canada).

It is too early to tell which destination is in the strongest position for long-term growth

Visa data shows that the recovery in student flows out of South Asia is well underway for both UK and Canada. However, flows from the Greater China region have not yet bounced back. In this respect, the strong preference in this region for the UK would suggest that the UK is in a better position for sustained post-COVID growth. The challenge for Canada will be to better reposition itself as a desirable destination in the minds of agents, students and parents.

In the medium-term, both Canada and the UK will need to be especially cognisant of how the resurgence of the USA might have significant knock-on effects on their relative attractiveness.

In the longer-term, future international student growth will be concentrated in the emerging markets of Africa and Latin America. It is early days yet and Canada’s present attractiveness will likely see significant competition from not just the UK, but all study destinations, both established and emerging.

In the more immediate future, the emergence of the COVID-19 Omicron variant suggests that it may still be too early to assume that 2022 will have any semblance of normality in international education for students, parents, agents and institutions alike.